By Gay Cororaton, MIAMI REALTORS® Chief Economist

The average 30-year fixed rate fell to 6.09% in the week of February 2, the fourth consecutive week of decline. Mortgage rates fell even as the Federal Reserve Board further slowed down on its rate increase to just 0.25% at the conclusion of its January 31-February 1 meeting, a slower pace than the half and quarter point increases in past months.

The members of the Federal Open Market Committee had deemed a cumulative increase of 0.75% increase in 2023 as appropriate to bring back inflation down to 2% , but it could be that the Fed will just go for one more rate hike to avoid a recession and with inflation easing.

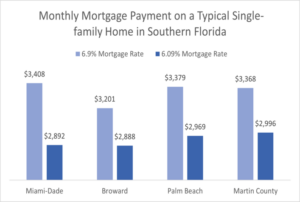

South Florida Homebuyers save $516 per month on a mortgage as interest rates decline from 7% to about 6%

The continuing decline in mortgage rates give buyers significant savings in mortgage payment with the interest rate decline than if rates had stayed at nearly 7%.

In Miami-Dade County, a buyer saves $516 in monthly mortgage payment on a typical single-family ($530,900) due to the decline in mortgage rates to 6.09% compared to the payment if the mortgage rate had stayed at nearly 7%. In Broward County, a buyer saves $313, and in Palm Beach County, a buyer saves $409.

Originally published at https://www.miamirealtors.com/2023/02/02/south-florida-homebuyers-save-about-500-per-month-with-decreasing-mortgage-rates/